The S&P/ASX Small Ordinaries (XSO) is the benchmark for Australian small-cap companies.

The index consists of the 200 companies in the S&P/ASX 300 index, but not in the S&P/ASX 100 index.

The Small Ords is well diversified with all 11 GICS Sectors represented and accounts for ~12% (November 2020) of Australia’s sharemarket capitalisation.

There’s currently one Exchange Traded Fund (ETF) that tracks the performance of the S&P/ASX Small Ordinaries: iShares S&P/ASX Small Ordinaries (SMLL).

IMPORTANT

IMPORTANTSmallOrdsList.com doesn’t provide share price data.

The best website is Market Index.

They have current ASX share prices, company charts and announcements, dividend data, directors’ transactions and broker consensus.

How are Small Ords companies selected?

Constituents are selected by a committee from Standard & Poor’s (S&P) and the Australian Securities Exchange (ASX).

The 200 stocks in the S&P/ASX 300 index, but not in the S&P/ASX 100 index, become eligible for inclusion in the index.

Rebalances occur if a constituent change is made in either the S&P/ASX 300 or S&P/ASX 100.

Small Ords List (1 June 2020)

Excel (CSV): Download

Excel (CSV): Download

Important Disclaimer

Company list compiled from BlackRock’s ASX:ISO publicly disclosed holdings and not official S&P data. Constituents change regularly and can be verified on the ASX website. If accuracy is important, contact S&P for official data.

| Code | Company | Sector | Market Cap | Weight(%) |

|---|---|---|---|---|

| ABP | Abacus Property Group | Real Estate | 1,679,500,000 | 0.63 |

| AX1 | Accent Group Ltd | Consumer Discretionary | 731,925,000 | 0.27 |

| ABC | Adbri Ltd | Materials | 1,930,710,000 | 0.72 |

| AQG | Alacer Gold Corp | Materials | 574,730,000 | 0.22 |

| AMA | AMA Group Ltd | Industrials | 460,852,000 | 0.17 |

| AYS | Amaysim Australia Ltd | Utilities | 94,435,300 | 0.04 |

| APE | AP Eagers Ltd | Consumer Discretionary | 1,677,770,000 | 0.63 |

| ADI | Apn Industria REIT | Real Estate | 480,242,000 | 0.18 |

| APX | Appen Ltd | Information Technology | 3,750,440,000 | 1.4 |

| ARB | ARB Corporation Ltd | Consumer Discretionary | 1,378,670,000 | 0.52 |

| ALG | Ardent Leisure Group Ltd | Consumer Discretionary | 201,477,000 | 0.08 |

| ARF | Arena REIT | Real Estate | 722,310,000 | 0.27 |

| AHY | Asaleo Care Ltd | Consumer Staples | 545,838,000 | 0.2 |

| AUB | AUB Group Ltd | Financials | 995,077,000 | 0.37 |

| AIA | Auckland International Airport Ltd | Industrials | 8,864,760,000 | 3.32 |

| AD8 | Audinate Group Ltd | Information Technology | 423,878,000 | 0.16 |

| AMI | Aurelia Metals Ltd | Materials | 310,264,000 | 0.12 |

| ASB | Austal Ltd | Industrials | 1,301,370,000 | 0.49 |

| AAC | Australian Agricultural Company Ltd | Consumer Staples | 632,905,000 | 0.24 |

| API | Australian Pharmaceutical Industries Ltd | Health Care | 569,018,000 | 0.21 |

| AVN | Aventus Group | Real Estate | 1,066,880,000 | 0.4 |

| AVH | Avita Medical Ltd | Health Care | 1,045,380,000 | 0.39 |

| BBN | Baby Bunting Group Ltd | Consumer Discretionary | 412,033,000 | 0.15 |

| BAP | Bapcor Ltd | Consumer Discretionary | 1,999,140,000 | 0.75 |

| BGA | Bega Cheese Ltd | Consumer Staples | 1,140,810,000 | 0.43 |

| BGL | Bellevue Gold Ltd | Materials | 627,488,000 | 0.24 |

| BIN | Bingo Industries Ltd | Industrials | 1,654,140,000 | 0.62 |

| BKL | Blackmores Ltd | Consumer Staples | 1,444,250,000 | 0.54 |

| BVS | Bravura Solutions Ltd | Information Technology | 1,194,840,000 | 0.45 |

| BRG | Breville Group Ltd | Consumer Discretionary | 3,076,680,000 | 1.15 |

| BKW | Brickworks Ltd | Materials | 2,343,520,000 | 0.88 |

| BUB | Bubs Australia Ltd | Consumer Staples | 588,310,000 | 0.22 |

| BWP | BWP Trust | Real Estate | 2,370,400,000 | 0.89 |

| BWX | BWX Ltd | Consumer Staples | 469,665,000 | 0.18 |

| CDD | Cardno Ltd | Industrials | 129,635,000 | 0.05 |

| CVN | Carnarvon Petroleum Ltd | Energy | 336,342,000 | 0.13 |

| CWP | Cedar Woods Properties Ltd | Real Estate | 446,485,000 | 0.17 |

| CNI | Centuria Capital Group | Financials | 883,940,000 | 0.33 |

| CIP | Centuria Industrial REIT | Real Estate | 1,164,800,000 | 0.44 |

| COF | Centuria Office REIT | Real Estate | 1,003,320,000 | 0.38 |

| CIA | Champion Iron Ltd | Materials | 1,387,700,000 | 0.52 |

| CLW | Charter Hall Long Wale REIT | Real Estate | 2,078,720,000 | 0.78 |

| CQR | Charter Hall Retail REIT | Real Estate | 1,844,150,000 | 0.69 |

| CQE | Charter Hall Social Infrastructure REIT | Real Estate | 854,677,000 | 0.32 |

| CNU | Chorus Ltd | 3,107,000,000 | 1.16 | |

| CUV | Clinuvel Pharmaceuticals Ltd | Health Care | 1,148,790,000 | 0.43 |

| CDA | Codan Ltd | Information Technology | 1,292,350,000 | 0.48 |

| CKF | Collins Foods Ltd | Consumer Discretionary | 927,987,000 | 0.35 |

| COE | Cooper Energy Ltd | Energy | 683,192,000 | 0.26 |

| CTD | Corporate Travel Management Ltd | Consumer Discretionary | 1,320,000,000 | 0.49 |

| CGC | Costa Group Holdings Ltd | Consumer Staples | 1,282,660,000 | 0.48 |

| CCP | Credit Corp Group Ltd | Financials | 1,065,190,000 | 0.4 |

| CMW | Cromwell Property Group | Real Estate | 2,129,490,000 | 0.8 |

| CSR | CSR Ltd | Materials | 2,043,460,000 | 0.77 |

| DCN | Dacian Gold Ltd | Materials | 255,882,000 | 0.1 |

| DTL | Data#3 Ltd | Information Technology | 865,339,000 | 0.32 |

| DHG | Domain Holdings Australia Ltd | Communication Services | 1,764,480,000 | 0.66 |

| ECX | Eclipx Group Ltd | Financials | 383,564,000 | 0.14 |

| ELD | Elders Ltd | Consumer Staples | 1,534,940,000 | 0.57 |

| EHL | Emeco Holdings Ltd | Industrials | 399,878,000 | 0.15 |

| EML | EML Payments Ltd | Information Technology | 1,338,090,000 | 0.5 |

| EHE | Estia Health Ltd | Health Care | 390,602,000 | 0.15 |

| FAR | FAR Ltd | Energy | 149,682,000 | 0.06 |

| FPH | Fisher & Paykel Healthcare Corporation Ltd | Health Care | 15,882,800,000 | 5.95 |

| FBU | Fletcher Building Ltd | Materials | 2,926,110,000 | 1.1 |

| FXL | Flexigroup Ltd | Financials | 453,550,000 | 0.17 |

| FNP | Freedom Foods Group Ltd | Consumer Staples | 966,733,000 | 0.36 |

| GUD | G.U.D. Holdings Ltd | Consumer Discretionary | 922,500,000 | 0.35 |

| GEM | G8 Education Ltd | Consumer Discretionary | 861,797,000 | 0.32 |

| GXY | Galaxy Resources Ltd | Materials | 319,394,000 | 0.12 |

| GDI | GDI Property Group | Real Estate | 599,121,000 | 0.22 |

| GMA | Genworth Mortgage Insurance Australia Ltd | Financials | 882,780,000 | 0.33 |

| GOR | Gold Road Resources Ltd | Materials | 1,636,270,000 | 0.61 |

| GNC | Graincorp Ltd | Consumer Staples | 1,009,250,000 | 0.38 |

| GOZ | Growthpoint Properties Australia | Real Estate | 2,477,410,000 | 0.93 |

| GWA | GWA Group Ltd | Industrials | 818,238,000 | 0.31 |

| HSN | Hansen Technologies Ltd | Information Technology | 628,269,000 | 0.24 |

| HVN | Harvey Norman Holdings Ltd | Consumer Discretionary | 4,186,580,000 | 1.57 |

| HLS | Healius Ltd | Health Care | 1,538,170,000 | 0.58 |

| HPI | Hotel Property Investments | Real Estate | 425,596,000 | 0.16 |

| HT1 | HT&E Ltd | Communication Services | 323,219,000 | 0.12 |

| HUB | HUB24 Ltd | Financials | 651,086,000 | 0.24 |

| IEL | Idp Education Ltd | Consumer Discretionary | 4,776,250,000 | 1.79 |

| IGO | IGO Ltd | Materials | 3,060,330,000 | 1.15 |

| IMD | IMDEX Ltd | Materials | 448,206,000 | 0.17 |

| IFN | Infigen Energy | Utilities | 582,419,000 | 0.22 |

| IFM | Infomedia Ltd | Information Technology | 604,749,000 | 0.23 |

| INA | Ingenia Communities Group | Real Estate | 1,368,240,000 | 0.51 |

| ING | Inghams Group Ltd | Consumer Staples | 1,233,980,000 | 0.46 |

| ITG | Intega Group Ltd | Industrials | 133,580,000 | 0.05 |

| IRI | Integrated Research Ltd | Information Technology | 592,920,000 | 0.22 |

| IAP | Investec Australia Property Fund | Real Estate | 718,275,000 | 0.27 |

| IVC | Invocare Ltd | Consumer Discretionary | 1,634,850,000 | 0.61 |

| INR | Ioneer Ltd | Materials | 193,187,000 | 0.07 |

| IFL | IOOF Holdings Ltd | Financials | 1,688,680,000 | 0.63 |

| IPH | IPH Ltd | Industrials | 1,629,410,000 | 0.61 |

| IRE | Iress Ltd | Information Technology | 1,978,000,000 | 0.74 |

| ISX | Isignthis Ltd | Information Technology | 1,172,250,000 | 0.44 |

| IGL | Ive Group Ltd | Communication Services | 169,697,000 | 0.06 |

| JHG | Janus Henderson Group Plc | Financials | 1,234,170,000 | 0.46 |

| JHC | Japara Healthcare Ltd | Health Care | 150,995,000 | 0.06 |

| JIN | Jumbo Interactive Ltd | Consumer Discretionary | 740,970,000 | 0.28 |

| JMS | Jupiter Mines Ltd | Materials | 568,107,000 | 0.21 |

| KAR | Karoon Energy Ltd | Energy | 326,261,000 | 0.12 |

| KGN | Kogan.com Ltd | Consumer Discretionary | 1,037,090,000 | 0.39 |

| LIC | Lifestyle Communities Ltd | Real Estate | 984,815,000 | 0.37 |

| LOV | Lovisa Holdings Ltd | Consumer Discretionary | 837,111,000 | 0.31 |

| LYC | Lynas Corporation Ltd | Materials | 1,464,490,000 | 0.55 |

| MAH | Macmahon Holdings Ltd | Materials | 560,296,000 | 0.21 |

| MGX | Mount Gibson Iron Ltd | Materials | 850,897,000 | 0.32 |

| MIN | Mineral Resources Ltd | Materials | 3,656,310,000 | 1.37 |

| MLD | Maca Ltd | Materials | 255,947,000 | 0.1 |

| MMS | Mcmillan Shakespeare Ltd | Industrials | 684,049,000 | 0.26 |

| MND | Monadelphous Group Ltd | Industrials | 1,123,480,000 | 0.42 |

| MNY | MONEY3 Corporation Ltd | Financials | 330,734,000 | 0.12 |

| MP1 | Megaport Ltd | Information Technology | 2,125,650,000 | 0.8 |

| MSB | Mesoblast Ltd | Health Care | 2,281,850,000 | 0.85 |

| MTS | Metcash Ltd | Consumer Staples | 2,750,160,000 | 1.03 |

| MVF | Monash Ivf Group Ltd | Health Care | 220,144,000 | 0.08 |

| MYR | Myer Holdings Ltd | Consumer Discretionary | 225,852,000 | 0.08 |

| MYS | Mystate Ltd | Financials | 363,435,000 | 0.14 |

| MYX | Mayne Pharma Group Ltd | Health Care | 713,604,000 | 0.27 |

| NAN | Nanosonics Ltd | Health Care | 2,164,350,000 | 0.81 |

| NCK | Nick Scali Ltd | Consumer Discretionary | 461,700,000 | 0.17 |

| NCZ | New Century Resources Ltd | Materials | 149,441,000 | 0.06 |

| NEA | Nearmap Ltd | Information Technology | 991,448,000 | 0.37 |

| NGI | Navigator Global Investments Ltd | Financials | 208,360,000 | 0.08 |

| NHC | New Hope Corporation Ltd | Energy | 1,139,440,000 | 0.43 |

| NIC | Nickel Mines Ltd | Materials | 941,369,000 | 0.35 |

| NSR | National Storage REIT | Real Estate | 1,808,630,000 | 0.68 |

| NUF | Nufarm Ltd | Materials | 2,122,490,000 | 0.8 |

| NWH | NRW Holdings Ltd | Industrials | 829,903,000 | 0.31 |

| NWL | Netwealth Group Ltd | Financials | 1,946,720,000 | 0.73 |

| NWS | News Corporation | Communication Services | 885,415,000 | 0.33 |

| NXT | NEXTDC Ltd | Information Technology | 4,090,870,000 | 1.53 |

| OBL | Omni Bridgeway Ltd | Financials | 1,161,870,000 | 0.44 |

| OFX | OFX Group Ltd | Financials | 323,134,000 | 0.12 |

| OGC | Oceanagold Corporation | Materials | 227,101,000 | 0.09 |

| OML | Ooh!Media Ltd | Communication Services | 645,049,000 | 0.24 |

| ORE | Orocobre Ltd | Materials | 681,647,000 | 0.26 |

| PDL | Pendal Group Ltd | Financials | 2,014,290,000 | 0.75 |

| PDN | Paladin Energy Ltd | Energy | 223,068,000 | 0.08 |

| PET | Phoslock Environmental Technologies Ltd | Industrials | 315,843,000 | 0.12 |

| PGH | Pact Group Holdings Ltd | Materials | 787,745,000 | 0.3 |

| PLS | Pilbara Minerals Ltd | Materials | 589,282,000 | 0.22 |

| PME | Pro Medicus Ltd | Health Care | 3,047,720,000 | 1.14 |

| PMV | Premier Investments Ltd | Consumer Discretionary | 2,603,080,000 | 0.98 |

| PNI | Pinnacle Investment Management Group Ltd | Financials | 781,508,000 | 0.29 |

| PNV | Polynovo Ltd | Health Care | 1,778,330,000 | 0.67 |

| PPT | Perpetual Ltd | Financials | 1,449,620,000 | 0.54 |

| PRN | Perenti Global Ltd | Materials | 866,264,000 | 0.32 |

| PRU | Perseus Mining Ltd | Materials | 1,553,510,000 | 0.58 |

| PTM | Platinum Asset Management Ltd | Financials | 2,211,780,000 | 0.83 |

| RDC | Redcape Hotel Group | Consumer Discretionary | 422,429,000 | 0.16 |

| REG | Regis Healthcare Ltd | Health Care | 439,093,000 | 0.16 |

| RFF | Rural Funds Group | Real Estate | 665,295,000 | 0.25 |

| RMS | Ramelius Resources Ltd | Materials | 1,413,350,000 | 0.53 |

| RRL | Regis Resources Ltd | Materials | 2,779,750,000 | 1.04 |

| RSG | Resolute Mining Ltd | Materials | 1,295,820,000 | 0.49 |

| SAR | Saracen Mineral Holdings Ltd | Materials | 5,768,120,000 | 2.16 |

| SBM | ST Barbara Ltd | Materials | 2,285,060,000 | 0.86 |

| SCP | Shopping Centres Australasia Property Group | Real Estate | 2,410,690,000 | 0.9 |

| SDA | Speedcast International Ltd | 189,396,000 | 0.07 | |

| SDF | Steadfast Group Ltd | Financials | 2,883,110,000 | 1.08 |

| SFR | Sandfire Resources Ltd | Materials | 811,044,000 | 0.3 |

| SGF | SG Fleet Group Ltd | Industrials | 443,050,000 | 0.17 |

| SGM | Sims Ltd | Materials | 1,572,670,000 | 0.59 |

| SHV | Select Harvests Ltd | Consumer Staples | 590,540,000 | 0.22 |

| SIG | Sigma Healthcare Ltd | Health Care | 630,317,000 | 0.24 |

| SIQ | Smartgroup Corporation Ltd | Industrials | 876,779,000 | 0.33 |

| SKC | Skycity Entertainment Group Ltd | Consumer Discretionary | 1,607,940,000 | 0.6 |

| SLC | Superloop Ltd | 402,453,000 | 0.15 | |

| SLR | Silver Lake Resources Ltd | Materials | 1,988,450,000 | 0.74 |

| SM1 | Synlait Milk Ltd | Consumer Staples | 1,194,180,000 | 0.45 |

| SPK | Spark New Zealand Ltd | 7,458,400,000 | 2.79 | |

| SPL | Starpharma Holdings Ltd | Health Care | 393,054,000 | 0.15 |

| SSM | Service Stream Ltd | Industrials | 824,213,000 | 0.31 |

| SUL | Super Retail Group Ltd | Consumer Discretionary | 1,687,030,000 | 0.63 |

| SVW | Seven Group Holdings Ltd | Industrials | 5,633,340,000 | 2.11 |

| SWM | Seven West Media Ltd | Communication Services | 141,499,000 | 0.05 |

| SXL | Southern Cross Media Group Ltd | Communication Services | 594,474,000 | 0.22 |

| SXY | SENEX Energy Ltd | Energy | 335,162,000 | 0.13 |

| SYR | Syrah Resources Ltd | Materials | 122,295,000 | 0.05 |

| TGR | Tassal Group Ltd | Consumer Staples | 817,654,000 | 0.31 |

| TNE | Technology One Ltd | Information Technology | 2,919,020,000 | 1.09 |

| UMG | United Malt Group Ltd | Consumer Staples | 1,295,510,000 | 0.49 |

| VEA | Viva Energy Group Ltd | Energy | 3,130,700,000 | 1.17 |

| VOC | Vocus Group Ltd | 1,867,920,000 | 0.7 | |

| VRL | Village Roadshow Ltd | Communication Services | 409,931,000 | 0.15 |

| VRT | Virtus Health Ltd | Health Care | 267,698,000 | 0.1 |

| VVR | Viva Energy REIT | Real Estate | 1,905,300,000 | 0.71 |

| WAF | West African Resources Ltd | Materials | 731,748,000 | 0.27 |

| WEB | Webjet Ltd | Consumer Discretionary | 1,457,710,000 | 0.55 |

| WGX | Westgold Resources Ltd | Materials | 1,000,150,000 | 0.37 |

| WPP | WPP AUNZ Ltd | Communication Services | 238,603,000 | 0.09 |

| WSA | Western Areas Ltd | Materials | 635,699,000 | 0.24 |

| Z1P | ZIP Co Ltd | Financials | 1,463,960,000 | 0.55 |

Archived Lists

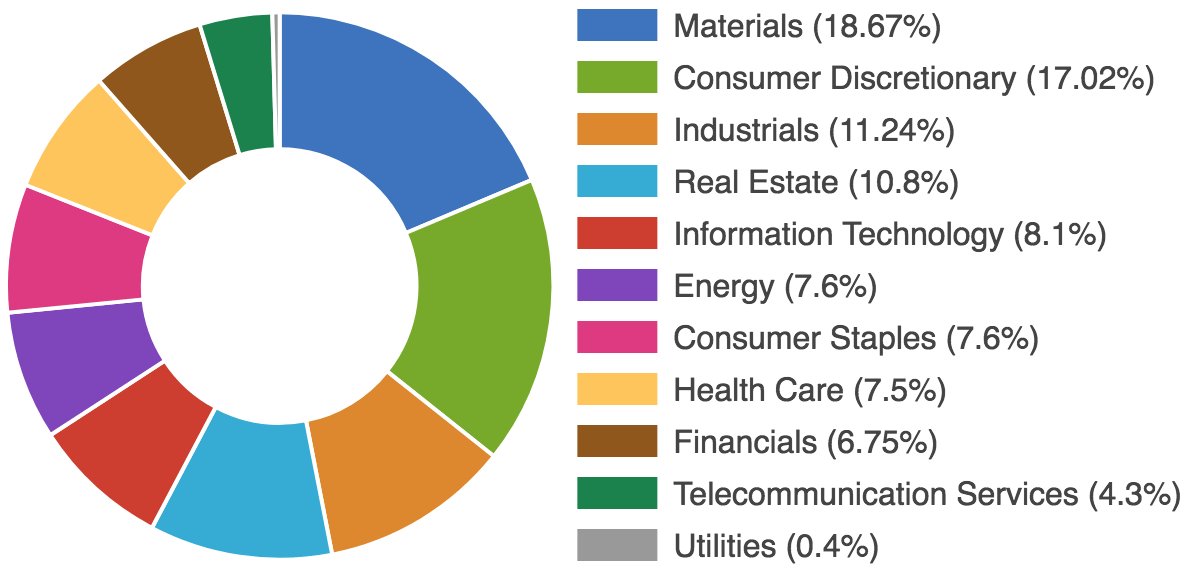

Sector breakdown

All S&P/ASX Indices use the Global Industry Classification Standard (GICS) to categorise companies according to their principal business activity.

The S&P/ASX Small Ordinaries Index is represented by all 11 GICS Sectors.

Data updated: April 2018

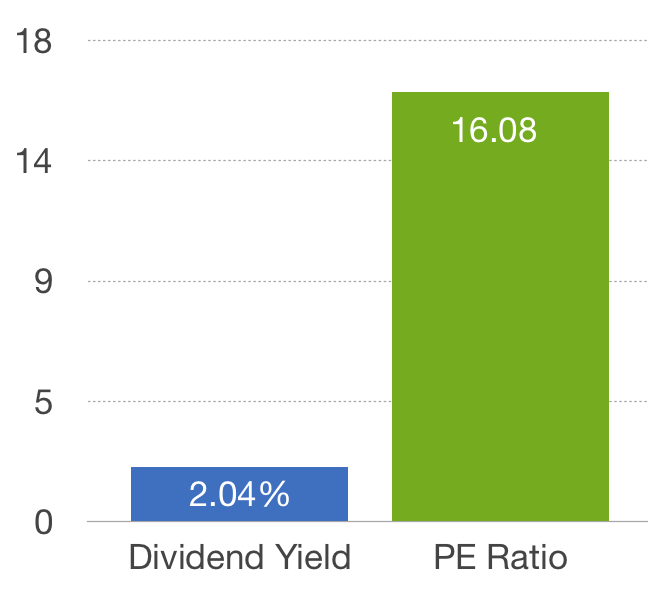

PE Ratio & Dividend Yield

Fundamental data for the ASX is weight-adjusted by market capitalisation. Companies with zero or negative values are ignored.

Data updated: April 2018

Exchange Traded Fund (ETF)

ETFs are managed funds that track a benchmark. They trade on the ASX like ordinary shares using their ticker code. The goal of an index fund is to replicate the performance of the underlying index, less fees and expenses.

As at May 2018, the iShares S&P/ASX Small Ordinaries (SMLL) is the only ETF that tracks the performance of the S&P/ASX Small Ordinaries Index.

| iShares S&P/ASX Small Ordinaries (SMLL) | |

|---|---|

| Manager: | BlackRock |

| Inception: | 6 Dec 2010 |

| Mgmt Fee: | 0.55% |

| Fact Sheet: | Link |